Rideshare Car Insurance

About Rideshare Car Insurance

Narrator: For instance, did you know you may not be fully covered while you are waiting to be matched with a customer.

On screen:

Passenger In Transit

Searching For Passengers

Narrator: If you've done your research you've probably heard of a gap in coverage for rideshare drivers.

On screen: Gap

Narrator: American Family’s Rideshare Coverage is a smart solution to that gap it's easy to add to your existing coverage and gives you the same coverage your personal insurance provides while you're waiting for a customer.

On screen: Rideshare Coverage

Coverage for the gap between your regular insurance and when you pick up a paying passenger.

Narrator: Simply tack this coverage on to your existing American Family auto policy and you're ready to pick up your next customer.

Narrator: Have other questions? Or, want to add gap coverage to your policy? Your American Family agent is the perfect person to help get in touch today.

On screen: American Family Insurance

Get a quote at AmFam.com

What Is Rideshare Insurance?

Rideshare insurance is car insurance available to drivers employed by ridesharing companies. This additional insurance can fill the gap in coverage between your personal auto policy and the insurance provided by the ridesharing company you are employed by.

Thinking about becoming a driver for companies like Uber or Lyft? We’ve got your back! Driving for ridesharing companies has its perks: flexibility, independence and the ability to earn extra income on your own schedule. However, it also means you’ll need extra insurance protection, too. Here’s why you need rideshare insurance.

Why Do I Need Rideshare Coverage?

Your personal auto insurance typically doesn’t offer coverage while you’re signed into rideshare driving apps. Likewise, companies like Uber and Lyft cover rideshare drivers once they accept a ride request and are en route towards picking up their passenger, and then once the passenger is in their car.

It does not, however, fully cover you when you’re logged into the app and waiting for ride requests. This creates a gap in your coverage, which our rideshare coverage is designed to cover.

Gaps Between Uber, Lyft, and Personal Auto Policies

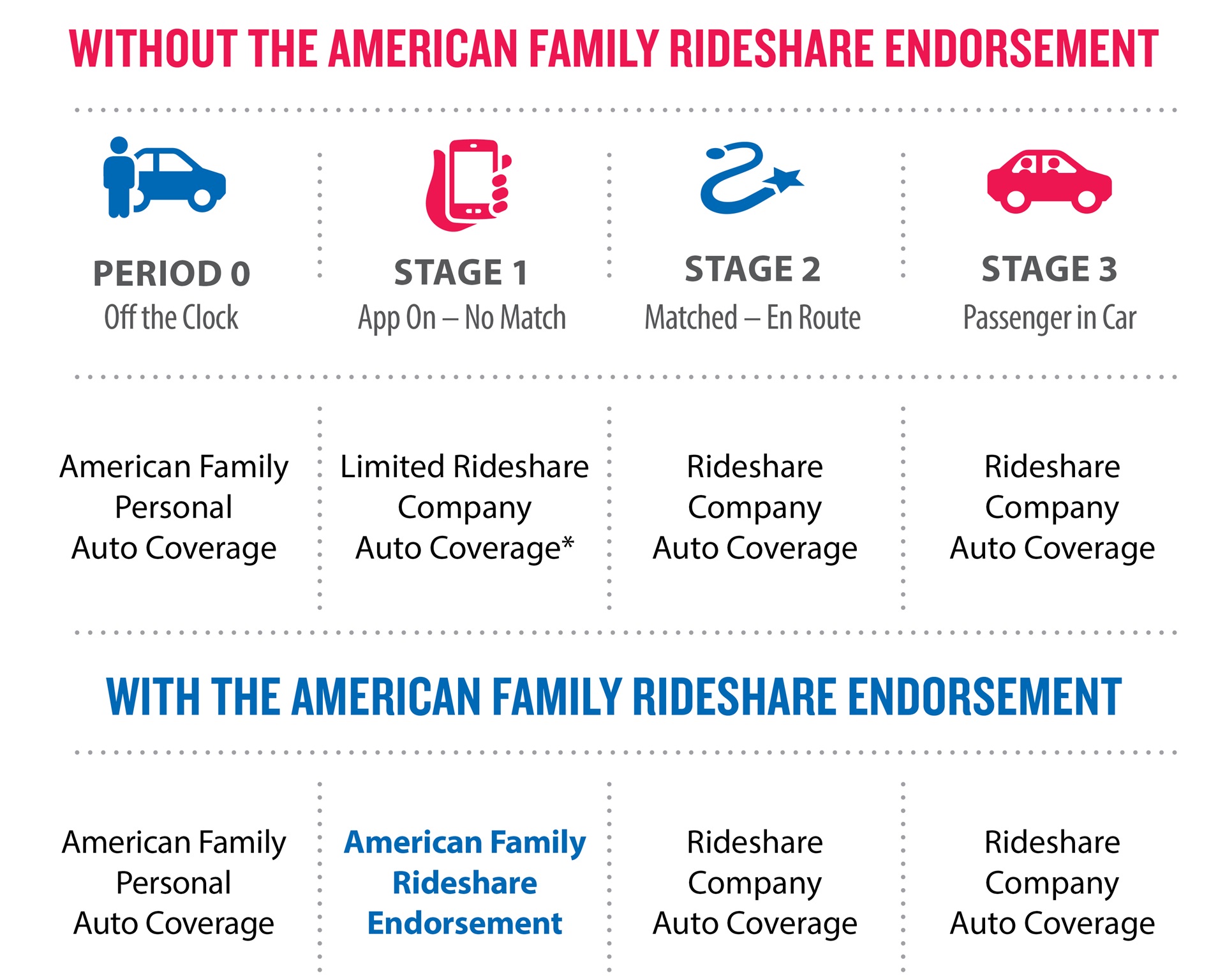

If you’ve done your research, you’ve probably heard of the “gap” in coverage when it comes to both your own personal auto insurance and the insurance provided by the rideshare company. Basically, from the moment you turn on the app and are waiting for a passenger, you aren’t covered by either your personal policy or your rideshare company’s insurance. This is considered the “gap” in coverage since you technically don’t have any during this time. Consider these stages:

Stage 0: App is off.

You’re covered by your personal car insurance policy.

Stage 1: App is on and you’re waiting for a ride request.

You're not covered by your personal auto policy, and you have limited coverage under your rideshare company's insurance.*

Stage 2: Ride request is accepted and you’re driving to the rider.

You’re covered by your rideshare company’s insurance.

Stage 3: Rideshare passenger is in the car.

You’re covered by your rideshare company’s insurance.

So how do you cover that gap? Fortunately for you, we’ve got a smart solution: American Family’s rideshare coverage. It’s a simple, affordable add-on to your existing personal auto policy and gives you peace of mind while driving wherever your entrepreneurial spirit takes you.

As a rideshare driver, it can be tricky navigating through Uber or Lyft driver insurance, so here’s a more detailed look at how you’re covered without rideshare endorsement, and with it, during the three main stages of a ridesharing trip.

What Does Rideshare Insurance Cover?

American Family’s rideshare insurance covers you from the moment your ridesharing app is turned on until you’ve been matched with a passenger. This car insurance coverage is ideal for drivers who work for Uber, Lyft, or other ridesharing companies. You’ll get the same coverage that you have with your personal auto policy, including:

- Bodily injury liability

- Property damage liability

- Collision and comprehensive

- Medical expense

- Personal injury protection

- Uninsured motorist bodily injury

- Underinsured motorist bodily injury

Keep in mind, if you don’t have the right coverage in place but still use your car to make money through a rideshare company like Lyft or Uber, your insurer won’t cover you if you get into an accident. Also, if they find out you’ve been driving without the proper insurance, they may decide to drop your coverage altogether.

What Does Uber or Lyft Insurance Cover?

Whether it’s an Uber insurance policy, Lyft insurance or another ridesharing service, their insurance policy typically only covers your liability as a driver while you’re logged into the app and matched with a rider. That means if your car damages someone else’s property, their coverage would kick in to help cover the expenses.

However, the insurance from your rideshare company does not cover any events while you are logged in and waiting for a rider. For instance, if you’re driving around waiting for a match and you get into an accident, you won’t be covered by your rideshare company’s insurance or your personal policy.

How to Get Rideshare Insurance

So are you ready to fully enjoy all the advantages of being a rideshare driver? Consider adding the protection and peace of mind you deserve, mile after mile with American Family Insurance's rideshare coverage.

Contact your agent to learn more about rideshare insurance eligibility in your state and how you can add it to your policy. Find more ways to save on your premium with auto discounts from American Family.

*Rideshare companies typically provide limited liability coverage only, and no comprehensive/collision coverage for damage to your car during Stage 1.